Liner shipping - a global, competitive industry.

Every year, 250 million containers are transported across the seas with over 7 trillion dollars’ worth of goods. It’s a hotly contested market, with more than 100 international liner ship operators providing over 2000 regularly scheduled services, most weekly, enabling trade between the nations of the world.

During the pandemic, extreme and unpredictable demand together with inland transport bottlenecks put supply chains to the test, driving up shipping rates. As condition normalised, so did the global supply network with rates and reliability returning to pre-COVID levels. Today, the dire security situation in the Red Sea is again putting pressure on supply chains, with uncertainty and capacity strain pushing rates up. Carriers are adjusting to the situation, striving to ensure safety for seafarers, customers cargo and vessels, while supporting customers as best possible.

Vessel space sharing allows ocean carriers to provide better service at a lower cost.

Across the world, carriers vie to serve producers and supply consumers with everything from cars, computers and clothing to medicines, machinery and mangoes. There are more than 7,000 container ships operating in liner services between all the world’s continents. To attract shippers, carriers compete on price, network, the quality of their customer service and increasingly also on their ability to minimize environmental impact.

The Liner shipping industry is characterized by high fixed costs in the form of investments in vessels and networks. The market has many price makers – carriers, freight forwarders, agents, exchanges – and as a well-functioning, competitive market it is very sensitive to demand and supply changes. To remain competitive, carriers must ensure the highest possible efficiency of operations to keep costs down, while maintaining the frequency and quality of their services.

That’s why vessel sharing (VSAs) is so fundamental for the functioning of global trade. VSAs are purely operational agreements that enable carriers to share space on one another’s ships. This way, carriers can ensure that vessels sail as full as possible, minimising the cost of transport as well as emissions. At the same time, vessel sharing allows more carriers to compete on a route, offering more frequent sailings and serving more ports. From a customer perspective, this means lower costs and better service, as well as reduced emissions.

Importantly, each member of a VSA determines its own commercial terms, including prices. Therefore, carriers within a VSA compete with each other, and with other carriers outside of that VSA, when selling their services to customers. Carriers also offer and add their own services outside of the VSAs in which they participate.

Access to efficient ocean transport is a strategic priority.

Today, as for the past hundred years, Liner shipping is seen by governments around the world as a strategically important industry. Being served by an efficient and well developed network of ocean carriers increases the competitiveness of a nations exports, while at the same time facilitating cost-efficient imports, growing the economy and increasing living standards. In times of national emergency, the merchant fleet keeps a country supplied with raw materials, medicines, fuel, food and other necessities to ensure the country’s resilience.

To ensure the best possible service at the lowest possible cost for their industry and citizens, most governments provide clear regulations, such as the European CBER and the UK BER, to facilitate the sharing of vessel space between carriers serving their ports. These regulations prescribe how carriers can contract for and operate vessel sharing agreements in a manner that preserves competitiveness and is in full compliance with competition regulations.

Concentration is low in Liner shipping.

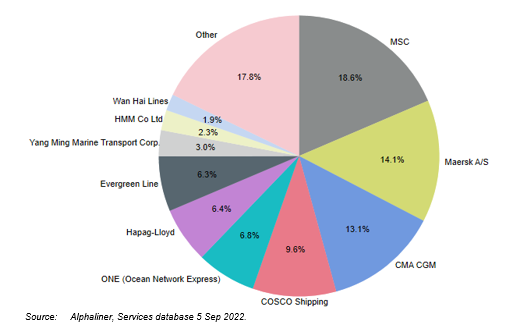

Market shares of top 10 carriers

HHI levels for various industries

Concentration remains limited in the liner shipping industry, both overall, and on a trade-by-trade basis. As illustrated on the left, there are no carriers with a capacity share above 20%, only three carriers with capacity shares higher than 10%, and only seven with capacity shares above 5% globally.

The largest carrier holds a 18.6% capacity share worldwide, and the top 5 carriers account for approximately 60% of the world fleet capacity, while it is necessary to aggregate the 9 largest carriers worldwide to reach a cumulative capacity share above 80%, with the top 10 only holding 82.2% of the global capacity. The remaining 17.8% of worldwide capacity is distributed amongst over 300 different carriers.

Positions are quite dynamic in the market. Between 2018 and 2022, capacity shares and ranking changing significantly: MSC and Maersk exchanged their first and second ranks, with shares increasing and decreasing by over 3.5 percentage point each. Evergreen retains its 7th position but has closed the gap with ONE and Hapag-Lloyd. In the same period, Wan Hai almost doubled its market share, and COSCO dropped below the 10% capacity share mark. The dynamism of capacity shares demonstrates the high degree of competition between carriers (local or regional as well as international).

This is confirmed by the Herfindahl–Hirschman Index (HHI), a commonly accepted measure to analyse concentration in markets, below 1,000 for the liner shipping industry globally. The HHI, which rates markets using a 0 to 10,000 scale, is used by competition authorities in the U.S. (the Department of Justice Antitrust Division and the Federal Trade Commission) and in the European Union (European Commission) to determine the existing level of concentration in a given market. The higher the number, the more concentrated the market — with an HHI below 1,500 considered competitive, between 1,500 to 2,500 moderately concentrated, and above 2,500 highly concentrated.

As an example, the HHI for the container shipping industry serving Northern Europe – U.S. is 1,508, and for Asia-North Europe it is 1,303. For Asia – U.S. West Coast it is 1,018. The global liner shipping industry HHI of below 1,000, is lower than in many other industries, including wireless carriers, domestic airlines and local broadcast television.

Download the research papers: